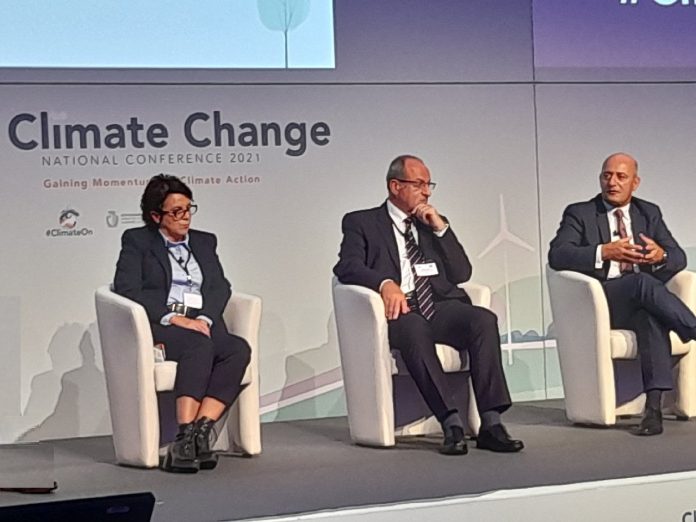

Speaking during the Financing a Green Transition session at the recent National Climate Change Conference, Michel Cordina, HSBC Malta’s Executive Director and Head of Business Development, highlighted that the low carbon transition is a strategic priority for the HSBC Group and that HSBC will be supplying up to US$1 trillion globally. These funds will be used to support customers to make the transition to net zero through Green and Sustainability Loans and Sustainable Investments.

Achieving net zero by 2030 will require significant investment and innovation. In this regard, the Group has also launched a US$100 million partnership programme to unlock new climate solutions with the World Wide Fund for Nature (WWF) and World Resources Institute. In Malta HSBC will also be benefitting from the outcome of this programme as well as

continuing to implement its own strategies to reduce emissions.

Cordina remarked that the biggest difference HSBC will make is by financing the customers transition to net zero and also by working in partnership with stakeholders to ensure no individuals, communities or businesses are left behind in the transition to net zero. This year alone the HSBC Group has already facilitated US$170 billion in Sustainable Finance and

Investment.

“As a bank with a global presence and 40 million customers, including our customer and market share in Malta, we have the potential to have a significant impact on this challenge by helping customers become more sustainable”, said Cordina.

Cordina also highlighted that the HSBC Malta Foundation is funding a 2-year project together with The Malta Chamber of Commerce titled ‘Establishing Malta’s framework for a net zero Carbon building’. This project is targeting the country’s Building and Construction Sector with the goal of raising standards in energy efficiency and conservation. Moreover, the recent

launch of the ‘HSBC Responsible Investment Fund’ has seen strong interest from Maltese customers.